for the named executive officers.

The following table shows, as of December 31,

2016,2020, each named executive

officer'sofficer’s years of credited service, present value of accumulated benefit and benefits received, if any, under the

Company'sCompany’s Pension Plan and the SERP.

| | | | | | | | | | | | |

Name | | Plan Name | | Number of

Years

Credited

Service(1) | | Present

Value of

Accumulated

Benefit(2) | | Payments

During

Last

Fiscal

Year | |

|---|

Walter Uihlein | | Acushnet Company Pension Plan | | | 39.92 | | $ | 1,552,379 | | | — | |

| | Acushnet Company Supplemental Retirement Plan | | | 39.92 | | $ | 11,973,003 | | | — | |

William Burke(3) | | Acushnet Company Pension Plan | | | 32.58 | | $ | 929,111 | | | — | |

| | Acushnet Supplemental Executive Retirement Plan | | | 32.58 | | $ | 2,164,443 | | | — | |

James Connor | | Acushnet Company Pension Plan | | | 29.42 | | $ | 1,314,861 | | | — | |

| | Acushnet Supplemental Executive Retirement Plan | | | 29.42 | | $ | 3,661,371 | | | — | |

David Maher | | Acushnet Company Pension Plan | | | 25.67 | | $ | 370,245 | | | — | |

| | Acushnet Supplemental Executive Retirement Plan | | | 25.67 | | $ | 278,471 | | | — | |

Joseph Nauman | | Acushnet Company Pension Plan | | | 20.50 | | $ | 777,629 | | | — | |

| | Acushnet Supplemental Executive Retirement Plan | | | 24.50 | | $ | 2,457,124 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Plan Name | | Number of

Years

Credited

Service(1) | | Present

Value of

Accumulated

Benefit(2) | | Payments

During

Last

Fiscal

Year |

| David Maher | | Acushnet Company Pension Plan | | 29.67 | | $ | 730,099 | | | — |

| | Acushnet Company Supplemental

Retirement Plan | | 29.67 | | $ | 3,236,388 | | | — |

| Thomas Pacheco | | Acushnet Company Pension Plan | | — | | | — | | | — |

| | Acushnet Supplemental Executive

Retirement Plan | | — | | | — | | | — |

| Mary Louise Bohn | | Acushnet Company Pension Plan | | 34.00 | | | $ | 1,332,296 | | | — |

| | Acushnet Supplemental Executive

Retirement Plan | | 34.00 | | | $ | 2,954,656 | | | — |

| Steven Pelisek | | Acushnet Company Pension Plan | | 26.50 | | | $ | 1,000,970 | | | — |

| | Acushnet Supplemental Executive

Retirement Plan | | 26.50 | | | $ | 2,059,579 | | | — |

| Christopher Lindner | | Acushnet Company Pension Plan | | — | | | — | | | — |

| | Acushnet Supplemental Executive

Retirement Plan | | — | | | — | | | — |

(1)Number of years of credited service represents actual years of service.

(2)PresentFor purposes of calculating the present value of the accumulated benefit is calculated by usingpension benefits, we used the same assumptions used and described in Note 13 to our audited financial statements filed with our Annual Report on Form 10-K for fiscal 2020, including a discount rate of 4.54%2.86% for the Pension Plan and 4.43%2.79% for the SERP.

(3)Mr. Burke's benefit reflects full controlled group benefit service with an offset for a benefit accrued and payable under a former controlled group company pension plan.

Pension Plan. The Pension Plan is a tax qualified defined benefit pension plan and the SERP is a nonqualified defined benefit pension plan. Each plan provides for payment of retirement benefits to a plan participant commencing between the ages of 50 and 65, as well as for payment of certain disability pension benefits. After attaining age 50 or completing five years of vesting service, a plan participant acquires a vested right to future benefits. The benefits payable under each of the plans are generally determined on the basis of an employee'semployee’s length of service and/or earnings and are normally paid as an annuity unless a lump sum election is made.

Each of the plans generally provides unreduced retirement benefits commencing on the participant'sparticipant’s normal retirement date, which is the first day of the calendar month coincident with or next following a participant'sparticipant’s 65th birthday, but a participant can receive reduced pension benefits as early as age 50. The Pension Plan provides benefits payable as either an annuity or a lump sum. Each

Table of Contentsof the named executive officers, other than Messrs. Pacheco and Lindner (who both commenced employment after the Pension Plan was closed to new participants), participates in the Pension Plan, is fully vested in his or her benefits under the Pension Plan and other than Mr. Maher, can commence his or her pension benefits immediately upon termination of employment. Upon attaining age 50, Mr. Maher can commence his pension benefits immediately upon termination.

Upon retirement, a salaried participant in the Pension Plan, such as

each of the named executive officers,

other than Messrs. Pacheco and Lindner, is entitled to a

monthly benefit equal to the sum of (a) 0.9% of his

or her average monthly rate of earnings multiplied by his

or her years of credited service and (b) 0.55% of that portion of his

or her average monthly rate of earnings that is in excess of his

or her covered compensation, multiplied by the lesser of (1) 35 and (2) his

or her years of credited service as a salaried employee. Average monthly compensation for this calculation is limited in accordance with the U.S. Internal Revenue Service (the

"IRS"“IRS”) compensation limit regulations under Code section 401(a)(17).

Plan participants, including Messrs. Burke and Nauman, who transferred directly to the Company from another company in the Company's prior controlled group (prior to July 2011), receive a benefit reflecting all service in the controlled group determined using the plan formula, with an offset for the benefit payable from the pension plan of the former controlled group company. At December 31, 2015, the Pension Plan was amended to freeze benefit accruals for certain participants and limit ongoing benefit accruals for other participants, based on age and service at that date. For participants who at December 31, 2015 had attained age of 50 and had completed at least ten years of service or had a combined age and years of service of 70 or more, the monthly benefit amount payable under the Pension Plan will equal the sum of (a) the

participant'sparticipant’s frozen accrued pension benefit at December 31, 2015, plus (b) benefit accruals after that time reflecting only service and pay earned in 2016 and

later and the benefit formula described above, but with final average

monthlyannual compensation limited to $150,000.

��

If a plan participant dies after age 50 and before benefits commence under the Pension Plan, his

or her spouse will generally be entitled to monthly pension benefits commencing on the first day of the month following the named executive

officer'sofficer’s death equal to 50% of the named executive

officer'sofficer’s assumed retirement pension, which is the monthly amount of pension benefits that he

or she would have received had he

or she retired immediately prior to his

or her death while the joint and survivor annuity was in effect with a provision for continuance of 50% of his

or her reduced amount of retirement benefit to his

or her spouse. The spouse may instead elect to receive a lump distribution equal to an amount that would be actuarially equivalent to the monthly benefit otherwise payable. If the plan participant has no spouse, his

or her beneficiary will be eligible to receive a lump sum distribution, calculated as noted above, using the assumption that the participant and beneficiary were of the same age. See

"—Pension“-Pension Benefits for

2016"2020” above for information relating to the accumulated benefits of our named executive officers.

SERP. The SERP is a nonqualified, unfunded excess benefit plan that supplements the benefits payable under the Pension Plan. Upon a participant'sparticipant’s retirement, the participant will be entitled to a benefit under the SERP equal to the difference between (a) and (b), where (a) is the sum of (A) 0.9% of his or her average monthly rate of earnings multiplied by his or her years of credited service and (B) 0.55% of that portion of his or her average monthly rate of earnings that is in excess of his or her covered compensation, multiplied by the lesser of (1) 35 and (2) his or her years of credited service as a salaried employee, and (b) is the benefit payable under the Pension Plan. Monthly average compensation for items (A) and (B) immediately above is not limited. Benefits payable under the SERP are generally paid to participants in a lump sum during the 60-day period following the participant'sparticipant’s retirement date, subject to any delay required under applicable tax rules. Each of Mr. Uihlein, Mr. Connor

Ms. Bohn and

Mr. Nauman is eligible to receive full retirement benefits under the Pension PlanMessrs. Maher and

SERP. Mr. Burke isPelisek are eligible to receive early retirement benefits under the Pension Plan and SERP.

Mr. Maher will becomeMessrs. Pacheco and Lindner are not eligible to

receive early retirement benefits upon attainmentparticipate in either the Pension Plan or SERP based on their dates of

age 50.hire. If a participant retires early, he

or she will be entitled to elect (1) a monthly retirement benefit as calculated above that commences on his

or her normal retirement date or (2) a reduced benefit payable at his

or her early retirement date. The early retirement benefit is equal to the 0.9% portion of his

Table of Contents

or her pension benefit reduced by the number of months by which his or her annuity starting date precedes his or her early retirement age (defined as age 64 for Mr. Burke) multiplied by 0.003 and (b) 0.55% of the portion of his or her benefit reduced by 0.5% for each of the first 60 months that his or her annuity starting date precedes the early retirement age or (y) 0.3% for each month in excess of 60 that the annuity starting date precedes the early retirement age. Mr. Connor retired from the Company effective January 1, 2017. Because Mr. Connor retired after his regular retirement date, he was eligible to receive full retirement benefits as described above.

Additionally, the Company has established and partially funded a rabbi trust to provide a source of funds for benefits payable from the SERP. For Mr. Uihlein, the Company has historically made annual contributions to a trust owned by Mr. Uihlein to fund a portion of Mr. Uihlein's SERP benefit. Upon Mr. Uihlein's termination of employment, a final contribution will be made to his trust in an amount which when added to the existing balance will equal the present value of the after-tax single sum equivalent of his supplemental retirement benefit to be paid within 60 days following his termination or death, or in the case of a termination for disability, within 60 days of his becoming disabled, in each case, subject to any delay required under applicable tax rules.

Nonqualified Deferred Compensation for 20162020

The following table provides a summary of the named executive officers'officers’ accounts that remain outstanding in our EDP for 2020 and shares deferred in 2020, together with the total deferred amounts as of December 31, 2020, under the Company's nonqualified executive deferral plan ("EDP") for 2016.Employee Deferral Plan. As of July 29, 2011, in connection with thea prior sale of the Company, by Beam all Company matching contributions and employee contributions to the planEDP were frozen and employee salary and incentive deferral accounts were distributed. All that remains in the planEDP is the portion of participants'participants’ accounts attributable to Company matching credits to the plan made prior to July 29, 2011. See "Compensation“Compensation Discussion and Analysis—ComponentsAnalysis-Components of our Executive Compensation Program—DeferredProgram-Deferred Compensation” above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Executive

Contributions in

Last Fiscal

Year | | Company

Contributions in

Last Fiscal

Year | | Aggregate

Earnings in

Last Fiscal

Year | | Aggregate

Withdrawals/

Distributions | | Aggregate

Balance at

Last Fiscal

Year | |

| David Maher | | $ | 2,412,778 | | (1) | — | | | $ | 359,428 | | | — | | $ | 4,964,885 | | (1) |

| | | | | $ | 15,452 | | | | | $ | 62,227 | | (2) |

| Thomas Pacheco | | — | | | — | | | — | | | — | | — | | |

| Mary Louise Bohn | | $ | 194,534 | | (1) | — | | | 666 | | | — | | $ | 346,008 | | (1) |

| Steven Pelisek | | — | | | — | | | — | | | — | | — | | |

| Christopher Lindner | | — | | | — | | | — | | | — | | — | | |

(1) Represents value of deferred shares, together with dividend equivalents that have been credited on such deferred shares, pursuant to the Company's Employee Deferral Plan. See "Compensation Discussion and Analysis-Components of our Executive Compensation Program-Deferred Compensation" above.

(2) Represents outstanding amounts under the EDP. | | | | | | | | | | | | | | | | |

Name | | Executive

Contributions in

Last Fiscal

Year | | Company

Contributions in

Last Fiscal

Year | | Aggregate

Earnings in

Last Fiscal

Year | | Aggregate

Withdrawals/

Distributions | | Aggregate

Balance at

Last Fiscal

Year | |

|---|

Walter Uihlein | | | — | | | — | | $ | 26,630 | | | — | | $ | 306,418 | |

William Burke | | | — | | | — | | $ | 5,634 | | | — | | $ | 95,317 | |

James Connor | | | — | | | — | | $ | 20,205 | | | — | | $ | 158,313 | |

David Maher | | | — | | | — | | $ | 1,448 | | | — | | $ | 31,014 | |

Joseph Nauman | | | — | | | — | | $ | 9,142 | | | — | | $ | 127,623 | |

Each of the named executive officers

Mr. Maher participates in the EDP and is fully vested in his account balance.

Account balances under the EDP are invested in a variety of mutual funds selected by the plan participants from a list of fund investment options similar to the investment options available under the Company’s defined contribution plan. Participants earn annual market rate returns based on the performance of the funds. Upon a separation from the Company,

these named executive officers areMr. Maher is entitled to the value of

their accountshis account in a lump sum no later than (1) December 31st of the year in which the separation occurs or (2) 90 days following the date of termination, subject to any delay required under applicable tax rules.

Account balances are invested in a variety of mutual funds selected by the plan participants from a list of fund investment options similar to the investment options available under the Company's defined contribution plan. Participants earn annual market rate returns based on the fund's performance.

Table of Contents

Potential Payments Upon Termination or Change in Control

The table below quantifies the potential payments and benefits that would be provided to each named executive officer under each of the termination or change in control circumstances listed. The amounts shown are based on the assumption that the triggering event took place on December

30, 2016,31, 2020, which was the last business day of

2016.2020.

The amounts shown in the table below do not include:

•payments and benefits to the extent they are provided generally to all salaried employees upon termination of employment or other circumstance and do not discriminate in scope, terms or operation in favor of the named executive officers;

•

•regular pension benefits under our Pension Plan or the SERP. See "—Pension“-Pension Benefits for 2016"2020” above; orand

•

•distributions of plan balances under our 401(k) Plan, the EDP or the EDP.delivery of deferred shares with respect to vested restricted stock units. See "—Nonqualified“-Nonqualified Deferred Compensation for 2016"2020” above for information relating to the distributions of the EDP account balances and delivery of deferred shares with respect to vested restricted stock units, in each case with respect to our named executive officers.

Table of Contents

Potential Payments Upon Termination or Change in Control

| | | | | | | | | | | | | | | | |

| | Retirement(1) | | Involuntary

Termination

without

Cause or

Voluntary

Termination

with Good

Reason | | Termination

For Cause | | Death or

Disability | | Change in

Control

followed by

Involuntary

Termination

without

Cause or

Voluntary

Termination

with Good

Reason | |

|---|

Walter Uihlein | | | | | | | | | | | | | | | | |

Annual incentive award(2) | | | 1,331,708 | | | 1,331,708 | | | — | | | 1,331,708 | | | 1,331,708 | |

LTIP awards(3) | | | — | | | — | | | — | | | — | | | — | |

Acceleration of Equity Awards(4) | | | 3,049,689 | | | — | | | — | | | — | | | 9,149,067 | |

Cash severance payment(5) | | | — | | | 6,829,285 | | | — | | | — | | | 10,013,956 | |

Health Insurance(6) | | | — | | | 138,732 | | | — | | | — | | | 208,098 | |

Life insurance | | | — | | | — | | | — | | | 6,077,400 | | | — | |

Accrued and unpaid vacation | | | 104,423 | | | 104,423 | | | 104,423 | | | 104,423 | | | 104,423 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 4,485,820 | | $ | 8,404,148 | | $ | 104,423 | | $ | 7,513,531 | | $ | 20,807,252 | |

William Burke | | |

| | |

| | |

| | |

| | |

| |

Annual incentive award(2) | | | 307,347 | | | 307,347 | | | — | | | 307,347 | | | 307,347 | |

LTIP awards(3) | | | 227,700 | | | 227,700 | | | — | | | 227,700 | | | 227,700 | |

Acceleration of Equity Awards(4) | | | 1,033,829 | | | — | | | — | | | — | | | 3,101,487 | |

Cash severance payment(5) | | | — | | | 723,000 | | | — | | | — | | | 964,000 | |

Life insurance | | | — | | | — | | | — | | | 2,812,000 | | | — | |

Accrued and unpaid vacation | | | 46,346 | | | 46,346 | | | 46,346 | | | 46,346 | | | 46,346 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,615,222 | | $ | 1,304,393 | | $ | 46,346 | | $ | 3,393,393 | | $ | 4,646,880 | |

James Connor | | |

| | |

| | |

| | |

| | |

| |

Annual incentive award(2) | | | 246,231 | | | 246,231 | | | — | | | 246,231 | | | 246,231 | |

LTIP awards(3) | | | 265,650 | | | 265,650 | | | — | | | 265,650 | | | 265,650 | |

Acceleration of Equity Awards(4) | | | 826,992 | | | | | | — | | | — | | | 2,480,977 | |

Cash severance payment(5) | | | — | | | 753,000 | | | — | | | — | | | 1,004,000 | |

Life insurance | | | — | | | | | | — | | | 2,827,200 | | | — | |

Accrued and unpaid vacation | | | 48,269 | | | 48,269 | | | 48,269 | | | 48,269 | | | 48,269 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,387,142 | | $ | 1,313,150 | | $ | 48,269 | | $ | 3,387,350 | | $ | 4,045,127 | |

David Maher | | |

| | |

| | |

| | |

| | |

| |

Annual incentive award(2) | | | 302,884 | | | 302,884 | | | — | | | 302,884 | | | 302,884 | |

LTIP awards(3) | | | 151,800 | | | 151,800 | | | — | | | 151,800 | | | 151,800 | |

Acceleration of Equity Awards(4) | | | 991,965 | | | — | | | — | | | — | | | 2,975,895 | |

Cash severance payment(5) | | | — | | | 712,500 | | | — | | | — | | | 950,000 | |

Life insurance | | | — | | | — | | | — | | | 1,842,000 | | | — | |

Accrued and unpaid vacation | | | 36,538 | | | 36,538 | | | 36,538 | | | 36,538 | | | 36,538 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,483,187 | | $ | 1,203,722 | | $ | 36,538 | | $ | 2,333,222 | | $ | 4,417,117 | |

Joseph Nauman | | |

| | |

| | |

| | |

| | |

| |

Annual incentive award(2) | | | 302,884 | | | 302,884 | | | — | | | 302,884 | | | 302,884 | |

LTIP awards(3) | | | 227,700 | | | 227,700 | | | — | | | 227,700 | | | 227,700 | |

Acceleration of Equity Awards(4) | | | 1,033,829 | | | — | | | — | | | — | | | 3,101,487 | |

Cash severance payment(5) | | | — | | | 712,500 | | | — | | | — | | | 950,000 | |

Life insurance | | | — | | | — | | | — | | | 2,676,000 | | | — | |

Accrued and unpaid vacation | | | 36,538 | | | 36,538 | | | 36,538 | | | 36,538 | | | 36,538 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,600,951 | | $ | 1,279,622 | | $ | 36,538 | | $ | 3,243,122 | | $ | 4,618,609 | |

37

(1)Each of the named executive officers, with the exception of David Maher, is retirement eligible under the awards and/or plans applicable to him as of December 31, 2016 and therefore any voluntary termination by the named executive officer, other than a termination for good reason, has been treated as a retirement for

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Retirement/Voluntary Termination | | Involuntary

Termination

without

Cause or

Voluntary

Termination

with Good

Reason | | Termination

For Cause | | Death or

Disability | | Change in Control | | Change in

Control

followed by

Involuntary

Termination

without

Cause or

Voluntary

Termination

with Good Reason |

| David Maher | | | | | | | | | | | | |

Annual incentive award(1) | | $ | 1,089,000 | | | $ | 1,089,000 | | | $ | — | | | $ | 1,089,000 | | | — | | | $ | 2,178,000 | |

Acceleration of Equity Awards(2) | | — | | | — | | | — | | | 11,488,336 | | | — | | | 11,488,336 | |

Cash severance payment(3) | | — | | | 1,350,000 | | | — | | | — | | | — | | | 1,800,000 | |

| Life insurance | | — | | | — | | | — | | | 2,801,000 | | | — | | | — | |

| Accrued and unpaid vacation | | 86,538 | | | 86,538 | | | 86,538 | | | 86,538 | | | — | | | 86,538 | |

| | | | | | | | | | | | |

| Total | | $ | 1,175,538 | | | $ | 2,525,538 | | | $ | 86,538 | | | $ | 15,464,874 | | | — | | | $ | 15,552,874 | |

| Thomas Pacheco | | | | | | | | | | | | |

Annual incentive award(1) | | $ | 344,850 | | | $ | 344,850 | | | $ | — | | | $ | 344,850 | | | — | | | $ | 344,850 | |

Acceleration of Equity Awards(2) | | — | | | — | | | — | | | 1,896,462 | | | — | | | 1,896,462 | |

Cash severance payment(3) | | — | | | 475,000 | | | — | | | — | | | — | | | 950,000 | |

| Life insurance | | — | | | — | | | — | | | 426,000 | | | — | | — | |

| Accrued and unpaid vacation | | 18,269 | | | 18,269 | | | 18,269 | | | 18,269 | | | — | | | 18,269 | |

| | | | | | | | | | | | |

| Total | | $ | 363,119 | | | $ | 838,119 | | | $ | 18,269 | | | $ | 2,685,581 | | | — | | | $ | 3,209,581 | |

| Mary Louise Bohn | | | | | | | | | | | | |

Annual incentive award(1) | | $ | 332,750 | | | $ | 332,750 | | | $ | — | | | $ | 332,750 | | | — | | | $ | 332,750 | |

Acceleration of Equity Awards(2) | | — | | | — | | | — | | | 2,353,317 | | | $ | 575,166 | | | 2,353,317 | |

Cash severance payment(3) | | — | | | 750,000 | | | — | | | — | | | — | | | 1,000,000 | |

| Life insurance | | — | | | — | | | — | | | 488,000 | | | — | | | — | |

| Accrued and unpaid vacation | | 57,692 | | | 57,692 | | | 57,692 | | | 57,692 | | | — | | | 57,692 | |

| | | | | | | | | | | | |

| Total | | $ | 390,442 | | | $ | 1,140,442 | | | $ | 57,692 | | | $ | 3,231,759 | | | $ | 575,166 | | | $ | 3,743,759 | |

| Steven Pelisek | | | | | | | | | | | | |

Annual incentive award(1) | | $ | 332,750 | | | $ | 332,750 | | | — | | | $ | 332,750 | | | — | | | $ | 332,750 | |

Acceleration of Equity Awards(2) | | — | | | — | | | — | | | 2,287,753 | | | $ | 552,749 | | | 2,287,753 | |

Cash severance payment(3) | | — | | | 750,000 | | | — | | | — | | | — | | | 1,000,000 | |

| Life insurance | | — | | | — | | | — | | | 970,000 | | | — | | | — | |

| Accrued and unpaid vacation | | 76,923 | | | 76,923 | | | 76,923 | | | 76,923 | | | — | | | 76,923 | |

| | | | | | | | | | | | |

| Total | | $ | 409,673 | | | $ | 1,159,673 | | | $ | 76,923 | | | $ | 3,667,426 | | | $ | 552,749 | | | $ | 3,697,426 | |

| Christopher Lindner | | | | | | | | | | | | |

Annual incentive award(1) | | $ | 332,750 | | | $ | 332,750 | | | $ | — | | | $ | 332,750 | | | — | | | $ | 332,750 | |

Acceleration of Equity Awards(2) | | — | | | — | | | — | | | 2,451,890 | | | — | | | 2,451,890 | |

Cash severance payment(3) | | — | | | 750,000 | | | — | | | — | | | — | | | 1,000,000 | |

| Life insurance | | — | | | — | | | — | | | 1,476,000 | | | — | | | — | |

| Accrued and unpaid vacation | | 19,231 | | | 19,231 | | | 19,231 | | | 19,231 | | | — | | | 19,231 | |

| | | | | | | | | | | | |

| Total | | $ | 351,981 | | | $ | 1,101,981 | | | $ | 19,231 | | | $ | 4,279,871 | | | — | | | $ | 3,803,871 | |

Table of Contents(1)

purposes of this table. Mr. Maher will become retirement eligible upon the attainment of age 50 in February, 2018. With respect to Mr. Maher, in the case of a voluntary termination, other than a voluntary termination for good reason, Mr. Maher would be eligible to receive all of the amounts listed under "Retirement" with the exception of the accelerated equity awards.

(2)- Represents value of the annual cash incentive award earned for

20162020 as included in the Summary Compensation Table. Other than in the case of a termination by the Company for cause, the named executive officer would receive the annual cash incentive award earned for 20162020 even if his employment terminated prior to the actual cash payout date in 2017.2021. See "Compensation“Compensation Discussion and Analysis—ComponentsAnalysis-Components of our Executive Compensation Program—Analysis of AnnualProgram-Annual Cash Incentives."

(3)For Messrs. Burke, Connor, Maher and Nauman, represents the value of the 2015-2016 LTIP award. Other than in the case of a termination by the Company for cause, the named executive officer would receive the 2015-2016 LTIP award earned through December 31, 2016 even if his employment terminated prior to the actual cash payout date in 2017.

(4)- ”

(2)Represents the pro rataaccelerated vesting of the Multi-Year RSUs and Multi-Year PSUs in accordance with the terms of the applicable award agreements. The value attributable to the acceleration of these unvested RSUs and PSUsawards is based on the closing price of our common stock ($19.71)40.54) on December 30, 2016,31, 2020, the last business day of 2016. With2020, and with respect to the accelerationPSU grants, assumes that the target level of the Multi-Year PSUs, reflects performance at target level. For more information on these awards, see "Compensation Discussion and Analysis—Components of our Executive Compensation Program—Analysis of Long-Term Incentives (LTIP, EAR, Multi-Year RSUs and Multi-Year PSUs)."

(5)was achieved.

(3)For Mr. UihleinMaher represents the amounts payable under his severance and change in control agreementsCEO Agreement as described below.For Messrs. Burke, Connor, Maher and Naumanthe other named executive officers, the cash severance amount represents the amounts payable to the named executive officer under the Executive Severance Plan as described below. Consistent with the terms of the Executive Severance Plan, in determining the amount of severance benefits for each of the named executive officers, the amount of the annual cash incentive to be paid as part of the severance benefits was offset by the annual incentive award earned by the named executive officer for 20162020 (as provided in table abovethe Summary Compensation Table and denoted bydescribed in footnote (2) above) which resulted in the payment of $0no additional annual cash incentive as part of the severance benefits.

(6)

Severance and Change in Control Arrangements

Executive Severance Plan

For 2020, all of the named executive officers, other than Mr. Uihlein, represents the annual premium amountsMaher, were eligible for medical, dental, life and disability insurance in accordance with the provisions of hisseverance benefits under our Executive Severance Plan. Mr. Maher’s severance and change in control agreementsentitlements are provided under the CEO Agreement, as described below.

Severance and Change in Control Arrangements

If the employment of a named executive officer covered under the Executive Severance Plan

If is terminated, other than following a Severance Plan participant's employment is terminatedchange in control as described below, (1) by the Company other than for cause or (2) by the participantnamed executive officer because the participant'shis or her job location has been relocated more than 35 miles from the participant'snamed executive officer’s former job location, and (3) the participantnamed executive officer was hired or promoted to the Corporate Management Committee ("CMC") level before January 1, 2019, he or she will receive (a) 18 months of base salary payable in installments plus (b) one year of bonus (based on the target bonus for the year of termination) offset by any bonus amount actually paid under the terms of the Company'sCompany’s annual bonus plan for the year of termination. If the named executive officer was hired or promoted to the CMC level January 1, 2019 or later, he or she will receive (a) 12 months of base salary plus (b) a pro-rated bonus (based on the target bonus for the year of termination payableand the number of days worked in installments.

the year of termination). The Executive Severance Plan also provides that during the severance period, medical benefits will be continued, with the Company continuing to make the same employer contributions as were in effect prior to the termination of the named executive officer’s employment.

Under the

Executive Severance Plan,

"cause"“cause” includes but is not limited to misconduct, negligence, dishonesty, criminal act, excessive absenteeism, and willful failure to perform job responsibilities and other conduct determined under the

Company'sCompany’s code of conduct or other policies to be

"cause."“cause.”

If a change in control occurs and, within 18 months of the change

ofin control (1) the Company terminates

the participanta covered named executive officer other than for cause, (2) the

participant voluntarynamed executive officer voluntarily terminates employment because his

or her job location has been relocated more than 35 miles from his

or her former job location, or (3) the

participantnamed executive officer voluntarily terminates his

or her employment due to (a) a material diminution in

thehis or her duties, authority or responsibilities or (b) a material negative change in the

participant'snamed executive officer’s compensation, the

participantnamed executive officer will receive: (x) 24 months of base salary

payable in installments plus (y) one year of annual cash incentive (based on the greater of (a) target bonus for the year of termination or (b) the annual cash incentive that would have been paid using the

Company'sCompany’s most recent financial performance outlook report that is

Table of Contents

available as of the employee'snamed executive officer’s termination date), in each case, offset by any annual cash incentive amount actually paid under the terms of the Company'sCompany’s annual cash incentive plan for the year of termination, payable in installments.

termination.

Payments under the

Executive Severance Plan are subject to execution of a release of claims. For a period of

the longer of 12 months after separation from employment

or the severance period, a

participantnamed executive officer may not, personally or on behalf of another party, whether directly or indirectly, solicit for employment any person employed by the Company in a salaried position during the year before separation from employment.

If Mr.

Uihlein's Severance and Change in Control Agreements Under his severance agreement, if Mr. UihleinMaher’s employment is terminated by the Company other than forwithout cause or if he resignsby Mr. Maher for good reason he will be entitled to:

•two times(each as defined in the sum of (1) his base salary; (2) his target annual incentive compensation under the annual cash incentive plan and (3) the amount that would have been required to be allocated to his account under the 401(k) Plan and Company contributions under the SERP, paid ratably over a 12-month period (unless payableCEO Agreement) other than within two yearstwelve months following a change in control (as defined in which case the payments are made in a lump sum six months following the termination date);

•continued health and welfare benefits for two years following his termination (with Mr. Uihlein paying the active employee rate);

•an amount equalEquity Plan), he will be entitled to the excess of (1) the sum of (i) one and one-half times his base salary, (ii) his target annual bonus, (iii) any earned but unpaid annual bonus for the aggregate monthly amounts of payments he would have been entitled to under the terms of each of the Company's pension plans if he remainedprior year and (iv) a fully vested active participant and accumulated two additional years of service thereunder over (2) the sum of the aggregate monthly amounts of payments he would be entitled to under each of the Company's pension plans, payable at the time payments are made under the SERP; and

•the (1) unpaidpro-rata portion of his target annual incentive compensation under the annual cash incentive plan for the calendar year immediately precedingbonus based on actual days employed in the year in which theof termination, occurs and (2) annual cash incentive compensation under the annual cash incentive plan for the calendar year in which the termination occurs, payable at the time the annual incentive awards for that year are normallysuch amounts to be paid in an amount equal to Mr. Uihlein's target percentage prorated for the portion of the year through the termination date.

Under Mr. Uihlein's severance agreement, "cause" generally includes (1) an act or acts of dishonesty on Mr. Uihlein's part that results in Mr. Uihlein being indicted for a felony, or (2) Mr. Uihlein's willful and continued failure substantially to perform his duties and responsibilitiesone cash lump sum as an officer of the Company (other than any such failure resulting from his incapacity due to physical or mental illness) after a demand for substantial performance is delivered to Mr. Uihlein by our Board of Directors which specifically identifies the manner in which our Board of Directors believes that Mr. Uihlein has not substantially performed his duties and Mr. Uihlein is given a reasonable timesoon as practicable after such demand substantially to perform his duties.

Under the severance agreement,qualifying termination. If Mr. Uihlein has "good reason" to resign if he voluntarily terminates hisMaher’s employment due to (1) a material change in his duties, without his express written consent, except in connection with the termination of his employment as a result of his death oris terminated by the Company for disability orwithout cause or by Mr. Uihlein other than for good reason; (2) a reduction by the Company in Mr. Uihlein's then current base salary; (3) the failure of the Company to substantially maintain and to continue Mr. Uihlein's participation in the Company's benefit plans unless participation in such plans ceases for similarly situated senior executives; (4) the relocation of the offices at which Mr. Uihlein is employed to a location more than 35 miles from his location at the time the severance agreement was entered into or requiring Mr. Uihlein to relocate to any office other than

Table of Contents

the Company's principal executive offices, except for required travel on the Company's business; (5) any reduction in the number of vacation days provided to Mr. Uihlein, unless such reduction is applicable to officers of the Company generally; (6) any failure of the Company to require any successor to assume and agree to perform his severance agreement; or (7) any purported termination of Mr. Uihlein's employment which is not effected pursuant to a notice of termination satisfying the requirements of his agreement. Mr. Uihlein must provide written notice to the Company of the existence of good reason no later than 90 days after its initial existence and the Company will have 30 days to cure such good reason condition.

Severance benefits are subject to Mr. Uihlein's signing of a release of claims. Under the severance agreement, Mr. Uihlein is subject to 12-month confidentiality, non-compete and non-solicitation covenants under which Mr. Uihlein shall hold all confidential trade secrets in confidence, and shall not (1) engage in nor be competitively employed by or render any services for any business in the United States, Canada, Asia, Mexico or Europe which is directly competitive with any significant business in which the Company or any of its affiliates was engaged during the two-year period preceding Mr. Uihlein's termination, and (2) solicit business from nor cause others to solicit business that competes with the Company's or any affiliate's line of products from any entities which were customers of the Company during Mr. Uihlein's employment or which were targeted as potential customers during his employment.

If a change in control occurs and Mr. Uihlein is subsequently terminated without cause (as defined above for the severance agreement) or resignsMaher for good reason within three years oftwelve months following a change in control, he will be entitled to:

•2.99 timesto the sum of (1)(i) two times his base salary; (2)salary, (ii) two times his target annual incentive compensation underbonus, (iii) any earned but unpaid annual bonus for the annual cash incentive plan;prior year and (3) the amount that would have been required to be allocated to his account under the 401(k) Plan, payable in(iv) a lump sum on the eighth day following the termination date;

•continued health and welfare benefits for three years following his termination (with Mr. Uihlein paying the applicable COBRA rate);

•an amount equal to the excess of (1) the sum of the aggregate monthly amounts of pension payments he would have been entitled to under the terms of the Company's pension plans if he remained a fully vested active participant and accumulated three additional years of age and service thereunder over (2) the sum of the aggregate monthly amounts of pension payments he would be entitled to under such pension plans upon his termination; and

•the (1) unpaidpro-rata portion of his incentive compensation under thetarget annual cash incentive plan for the calendar year immediately precedingbonus based on actual days employed in the year of termination, such amounts to be paid in which theone cash lump sum as soon as practicable after such qualifying termination, occurs and (2) incentive compensation under the annual cash incentive plan for the calendar year in which the termination occurs, payable at the time the annual incentive awards for that year are normally paid based on the Company's actual performance.

Any benefits paid under the change in control agreement will be offset by the benefits payable above under Mr. Uihlein's severance agreement. Benefits under the change in control agreement are subject to Mr. Uihlein signing a release of claims.

In addition, Mr. Uihlein's change in control agreement provides that to the extent that any or all of the change in control payments and benefits provided to Mr. Uihlein under the change in control agreement constitute "parachute payments" within the meaning of Section 280G of the Code and would otherwise be subject to the excise tax imposed by Section 4999 of the Code, the Company will pay Mr. Uihlein an additional amount such that the net amount retained by Mr. Uihlein after the deduction of any excise, federal, state and local income tax will be equal to the payments he is entitled to under the change in control agreement. However, if the value of the payments Mr. Uihlein is

Table of Contents

entitled to do not exceed 330% of the base amount, no gross-up payment will be made and any payments and benefits would be reduced by the minimum amounts necessary to equal one dollar less than the amount which would resultoutstanding Company equity interests will vest in such payments and benefits being subject to such excise tax, but only if the value of the reductionfull. If Mr. Maher’s employment is equal to or less than 30% of Mr. Uihlein's base salary. For purposes of the quantification of possible payments due to Mr. Uihlein in each of the scenarios set forth in the table under the heading "Potential Payments Upon Termination or Change in Control" above, it is assumed that no excise taxes would be imposed. As such, the amounts in the table do not reflect a gross-up payment with respect to any excise tax imposed by Section 4999 of the Code.

Under the change in control agreement, Mr. Uihlein has "good reason" to resign if he voluntarily terminates his employment due to (1) without Mr. Uihlein's express written consent, the assignment to Mr. Uihlein of any duties inconsistent with his positions, duties, responsibilities and status with the Company at the time of a change in control, or a change in his reporting responsibilities, titles or offices as in effect at the time of a change in control, or any removal of him from, or any failure to re-elect him to, any of such positions, except in connection with the termination of his employmentterminated as a result of his death or disability, he is entitled to the sum of (i) any earned but unpaid annual bonus for the prior year and (ii) a pro-rata portion of his target annual bonus based on days employed in the year of termination, such amounts to be paid in one cash lump sum as soon as practicable after such termination of employment. Mr. Maher is not entitled to receive severance if his employment is terminated for any other reason.

Change in Control and Retirement Vesting under Equity Awards

Pursuant to the terms of the Company’s Equity Plan, any unvested RSUs or PSUs are forfeited upon an executive’s separation from service with the Company, except in the case of a separation from service by the Company for disability or causewithout Cause or by Mr. Uihleinthe executive for Good Reason occurring during the 18-month period following a Change in Control (each, as defined in the Equity Plan),

in which case all unvested RSUs and PSUs will vest in full, with PSUs vesting at the greater of actual performance and target performance.

Upon a Full Career Retirement (defined in the Equity Plan as a separation from service with the Company other than for

good reason; (2)Cause when a

reduction byparticipant is age 55 with 10 years of service with the

Company in Mr. Uihlein's then current base salary; (3)Company), after the

failurefirst anniversary of the

Companyvesting commencement date, the PSUs will remain eligible to

substantially maintain and to continue Mr. Uihlein's participation in the Company's benefit plans as in effect at the time of a change in control and with all subsequent improvements (other than those plans or improvements that have expired in accordance with their original terms), or the taking of any action which would materially reduce Mr. Uihlein's benefits under any of such plans or deprive Mr. Uihlein of any material fringe benefit enjoyed by him at the time of a change in control; (4) the target bonus awarded to Mr. Uihlein under the incentive compensation plan of the Company subsequent to a change in control being less than such amount last awarded to him prior to a change in control; (5) the sum of Mr. Uihlein's base salary and amount paid to him as incentive compensation under the incentive compensation plan of the Company for the calendar year in which the change in control occurs or any subsequent year being less than the sum of his base salary and the amount awarded (whether or not fully paid) to him as incentive compensation under the incentive compensation plan of the Company for the calendar year prior to the change in control or any subsequent calendar year in which the sum of such amounts was greater; (6) the relocation of the offices at which Mr. Uihlein is employed to a location more than 35 miles from his location at the time of a change in control or the Company requiring Mr. Uihlein to be based anywhere other than at such offices, except for required travel on the Company's business to an extent substantially consistent with Uihlein's business travel obligations at the time of a change in control; (7) the failure of the Company to provide Mr. Uihlein with a number of paid vacation days at least equal to the number of paid vacation days to which he is entitled at the time of change in control; (8) any purported termination of Mr. Uihlein's employment which is not effected pursuant to a notice of termination satisfying the requirements of his agreement; or (9) Mr. Uihlein's good faith determination that due to a change in control he is not able effectively to discharge his duties.Transition Agreement with Joseph Nauman

In April 2017, the Company entered into a Transition Agreement with Mr. Nauman pursuant to which Mr. Nauman will continue to serve as the Company's Executive Vice President, Chief Legal Officer and Administrative Officer until December 31, 2017, unless Mr. Nauman's employment is terminated by either party prior to such date. For additional information on the Transition Agreement, including the payments and benefits Mr. Nauman will receive thereunder, see "—Severance and Change in Control Arrangements—Transition Agreement with Joseph Nauman" above.

Table of Contents

LTIP

Retirement, death or disability. If a participant retires, dies or becomes disabled during a performance period, the participant will be eligible for a prorated awardvest based on service while an active participant (measured in months with a partial month rounded up) during theactual performance period, with payment of the award made followingmeasured at the end of the performance period. For purposes of the LTIP, "retire" means to terminate employment on or after attaining age 55 and completing at least ten years of serviceperiod, with the Company and its affiliates, and "disabled" means disabled as defined innumber of performance shares delivered to the Company's long term disability plan. If a participant's employment withexecutive prorated to reflect the Company and all of its then-current affiliates is terminated for cause prior toexecutive’s actual service during the three-year performance period. At the end of a performance period, no awards for that period will be paid2020, Ms. Bohn and Mr. Pelisek were retirement eligible under the LTIP.

Change in control. In the event of a change in control, all outstanding awards under the LTIP will be paid out as soon as practicable following such change in control (1) as if all performance periods have been completed and based on actual performance data to the extent available and the Company's forecast in the performance outlook report for the remainderterms of the applicable performance period, but (2) prorated (measured in months with a partial month rounded up) for the portion of any relevant performance period ending on the date of such change in control. Under the LTIP, the term "change in control" has the same meaning ascribedPSUs awarded to such term in the Severance Plan.them.

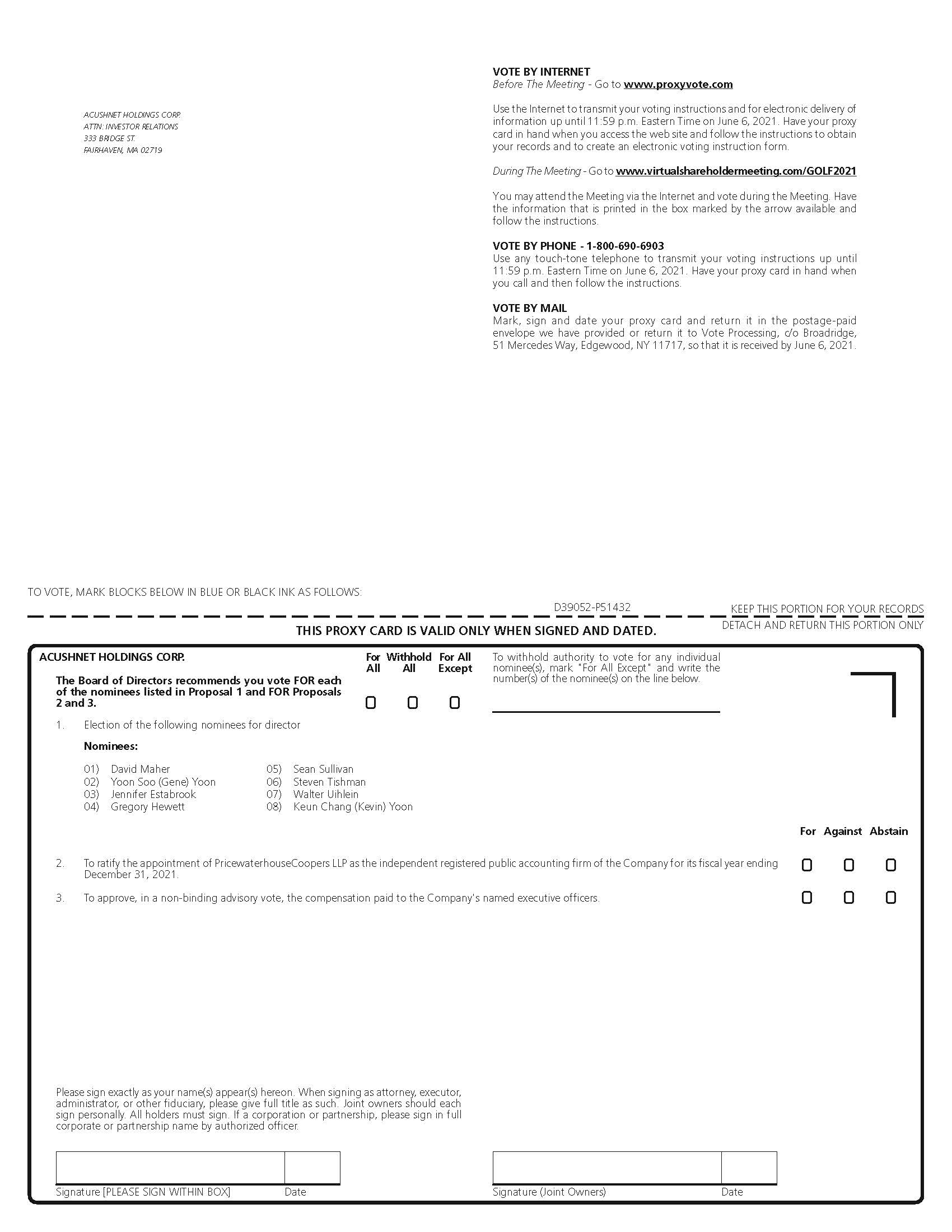

Director Compensation

For fiscal 2016 prior to our initial public offering, we did not provide director compensation to our non-executive directors. However, all of our directors were and continue to be reimbursed for their reasonable out-of-pocket expenses related to their services as a member of the board of directors of Acushnet Holdings Corp. or Acushnet Company.

In connection with our initial public offering, the board of directors of Acushnet Holdings Corp. approved the following annual compensation for its directors:

•The chairperson of the board of directors receives a $110,000 annual cash retainer paid quarterly in arrears and an annual grant of RSUs with a fair market value at the time of grant of $140,000. Such RSUs will vest on the earlier of the one-year anniversary of the grant or the next annual stockholders' meeting.

•Non-executive board members, other than the chairperson, receive a $70,000 annual cash retainer paid quarterly in arrears and an annual grant of RSUs with a fair market value of at the time of grant of $100,000. Such RSUs will vest on the earlier of the one-year anniversary of the grant or the next annual stockholders' meeting.

•The audit committee chairperson receives an additional $25,000 annual cash retainer; the compensation committee chairperson receives an additional $20,000 annual cash retainer and the nominating and corporate governance committee chairperson receives an additional $10,000 annual cash retainer; in each case paid quarterly in arrears.

•Audit committee members, other than the audit committee chairperson, receive an additional $12,500 annual cash retainer; compensation committee members, other than the compensation committee chairperson, receive an additional $10,000 annual cash retainer and nominating and corporate governance committee members, other than the nominating and corporate governance committee chairperson, receive an additional $5,000 annual cash retainer; in each case paid quarterly in arrears. These annual compensation arrangements took effect immediately following our initial public offering with the first annual grant of RSUs to be made in June 2017. In June 2017, in addition to the annual grant of RSUs for 2017, each non-executive director is expected to receive a "catch-up" grant of RSUs, representing a pro rata portion of the annual RSU grant, and intended to cover the period commencing on the pricing of the Company's initial public offering through the date of the 2017

Table of Contents

Annual Meeting. These additional RSUs will vest on the one-year anniversary of the pricing of the Company's initial public offering.

Following our initial public offering, our board of directors adopted the Acushnet Holdings Corp. Independent Directors Deferral Plan, which generally permits non-executive directors the opportunity to defer delivery of common stock (and associated income taxes) following the vesting of RSUs.

The following table sets forth information concerning the compensation of our directors (other than directorsMr. Maher, who are named executive officers)receives no additional compensation as a director and whose compensation is reported in the Summary Compensation Table above) for 2016.

2020.

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Fees

Earned or

Paid in

Cash | | Stock

Awards | | Non-Equity

Incentive Plan

Compensation | | Change in

Pension Value

and

Non-qualified

Deferred

Compensation

Earnings | | All Other

Compensation | | Total | |

|---|

Yoon Soo (Gene) Yoon(1) | | $ | 1,092,900 | | | — | | $ | 670,084 | | | — | | $ | 30,101 | (2) | $ | 1,793,085 | |

Jennifer Estabrook | | $ | 15,833 | | | — | | | — | | | — | | | — | | $ | 15,833 | |

Gregory Hewett | | $ | 15,417 | | | — | | | — | | | — | | | — | | $ | 15,417 | |

Christopher Metz | | $ | 13,333 | | | — | | | — | | | — | | | — | | $ | 13,333 | |

Sean Sullivan | | $ | 15,833 | | | — | | | — | | | — | | | — | | $ | 15,833 | |

Steve Tishman | | $ | 13,750 | | | — | | | — | | | — | | | — | | $ | 13,750 | |

David Valcourt | | $ | 13,333 | | | — | | | — | | | — | | | — | | $ | 13,333 | |

Norman Wesley | | $ | 12,500 | | | — | | | — | | | — | | | — | | $ | 12,500 | |

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees

Earned or

Paid in

Cash | | Stock

Awards(1)(2) | | Total |

| Yoon Soo (Gene) Yoon | | $ | 110,000 | | | $ | 139,985 | | | $ | 249,985 | |

| Jennifer Estabrook | | $ | 95,000 | | | $ | 109,983 | | | $ | 204,983 | |

| Gregory Hewett | | $ | 92,500 | | | $ | 109,983 | | | $ | 202,483 | |

| Sean Sullivan | | $ | 100,000 | | | $ | 109,983 | | | $ | 209,983 | |

| Steven Tishman | | $ | 92,500 | | | $ | 109,983 | | | $ | 202,483 | |

Walter Uihlein(3) | | $ | 82,000 | | | $ | 109,983 | | | $ | 191,983 | |

Norman Wesley(4)(5) | | $ | 32 | | | $ | — | | | $ | 32 | |

| Keun Chang (Kevin) Yoon | | $ | 70,000 | | | $ | 109,983 | | | $ | 179,983 | |

- (1)

In addition to serving as chairman of our board of directors, Mr. Yoon served as President ofRepresents the Company from 2011 until May 2016. During 2016, Mr. Yoon earned $18,333 in director fees. The remainder of his compensation reflects amounts earned in his capacity as President. Not included in Mr. Yoon's compensation for 2016 is $50,979,600 realized on the payout of EARs on February 17, 2017 and March 15, 2017. For additional information on the EARs, see "Compensation Discussion and Analysis—Components of our Executive Compensation Program—Analysis of Long-Term Incentives (LTIP, EAR, Multi-Year RSUs and Multi-Year PSUs)—EARs."

(2)Reflects the Company's reimbursement of health care premiums paid by Mr. Yoon.

Equity Compensation Plans.

On January 22, 2016, the Company's board of directors adopted and stockholders approved the Acushnet Holdings Corp. 2015 Incentive Plan, which we refer to as our 2015 Incentive Plan.

Purpose. The purpose of the 2015 Incentive Plan is to provide a means through which to attract and retain key personnel and to provide a means whereby our directors, officers, employees, consultants and advisors (and prospective directors, officers, employees, consultants and advisors) can acquire and maintain an equity interest in us, or be paid incentive compensation, including incentive compensation measured by reference to theaggregate grant date fair value of our commonfully vested stock thereby strengthening their commitmentgranted to our welfare and aligning their interests with those of our stockholders.

Administration. Our 2015 Incentive Plan is administered by the Company's board of directors and the Company's compensation committee (each, as applicable, the "Administrator"). The Administrator has the sole and plenary authority to establish the terms and conditions of any award, consistent with the provisions of our 2015 Incentive Plan. The Administrator is authorized to interpret, administer, reconcile any inconsistencyeach director in correct any defect in and/or supply any omission in our 2015 Incentive Plan and any instrument or agreement relating to, or any award granted under, our 2015 Incentive Plan; establish, amend, suspend, or waive any rules and regulations and appoint such agents as the

Table of Contents

Administrator deems appropriate for the proper administration of our 2015 Incentive Plan; and to make any other determination and take any other action that the Administrator deems necessary or desirable for the administration of our 2015 Incentive Plan. Except to the extent prohibited by applicable law or the applicable rules and regulations of any securities exchange or inter-dealer quotation system on which our securities are listed or traded, the Administrator may allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers to any person or persons selected by it2020, computed in accordance with the terms of our 2015 Incentive Plan. Any such allocation or delegation may be revoked by the Administrator at any time. Unless otherwise expressly provided in our 2015 Incentive Plan, all designations, determinations, interpretations, and other decisions under or with respect to our 2015 Incentive Plan or any award or any documents evidencing awards granted pursuant to our 2015 Incentive Plan are within the sole discretion of the Administrator, may be made at any time and are final, conclusive and binding upon all persons or entities, including,ASC Topic 718, without limitation, us, any participant, any holder or beneficiary of any award, and any of our stockholders.

taking into account estimated forfeitures.

Shares Subject to our 2015 Incentive Plan.(2) Our 2015 Incentive Plan provides thatThe following table shows the total number of shares of common stock that may be issued under our 2015 Incentive Plan is 8,190,000, 4,501,251 shares of which remained available for future grants as of December 31, 2016. The maximum number of shares for which incentive stock options may be granted under the plan is 8,190,000; the maximum number of shares for which options or stock appreciation rights may be granted to any individual participant during any single fiscal year is 1,485,000; the maximum number of shares for which performance compensation awards denominated in shares may be granted to any individual participant in respect of a single fiscal year is 1,485,000 (or if any such awards are settled in cash, the maximum amount may not exceed the fair market value of such shares on the last day of the performance period to which such award relates); the maximum number of shares of common stock granted during a single fiscal year to any non-employee director, taken together with any cash fees paid to such non-employee director during the fiscal year, will not exceed $1,000,000 in total value; and the maximum amount that may be paid to any individual participant for a single fiscal year under a performance compensation award denominated in cash is $10,000,000. Except for substitute awards (as described below), if any award expires or is canceled, forfeited, terminated, lapses, or otherwise settles without the delivery of the full number of shares subject to such award, including as a result of net settlement of the award or as a result of the award being settled in cash, the undelivered shares may be granted again under our 2015 Incentive Plan, unless the shares are surrendered after the termination of our 2015 Incentive Plan, and only if stockholder approval is not required under the then-applicable rules of the exchange on which the shares of common stock are listed. Awards may, in the sole discretion of the Administrator, be granted in assumption of, or in substitution for, outstanding RSU awards previously granted by an entity directly or indirectly acquired by us or with which we combine (referred to as "substitute awards"), and such substitute awards will not be counted against the total number of shares that may be issued under our 2015 Incentive Plan, except that substitute awards intended to qualify as "incentive stock options" will count against the limit on incentive stock options described above. No award may be granted under our 2015 Incentive Plan after the tenth anniversary of the effective date of the plan, but awards theretofore granted may extend beyond that date. Options. The Administrator may grant non-qualified stock options and incentive stock options, under our 2015 Incentive Plan, with terms and conditions determined by the Administrator that are not inconsistent with our 2015 Incentive Plan; provided, that all stock options granted under our 2015 Incentive Plan are required to have a per share exercise price that is not less than 100% of the fair market value of our common stock underlying such stock options on the date such stock options are granted (other than in the case of options that are substitute awards), and all stock options that are intended to qualify as incentive stock options must be granted pursuant to an award agreement expressly stating that the options are intended to qualify as incentive stock options, and will be subject to the terms and conditions that comply with the rules as may be prescribed by Section 422 of the

Table of Contents

Code. The maximum term for stock options granted under our 2015 Incentive Plan will be ten years from the initial date of grant, or with respect to any stock options intended to qualify as incentive stock options, such shorter period as prescribed by Section 422 of the Code. However, if a non-qualified stock option would expire at a time when trading of shares of common stock is prohibited by our insider trading policy (or "blackout period" imposed by us), the term will automatically be extended to the 30th day following the end of such period. The purchase price for the shares as to which a stock option is exercised may be paid to us, to the extent permitted by law, (i) in cash or its equivalent at the time the stock option is exercised; (ii) in shares having a fair market value equal to the aggregate exercise price for the shares being purchased and satisfying any requirements that may be imposed by the Administrator; or (iii) by such other method as the Administrator may permit in its sole discretion, including, without limitation, (A) in other property having a fair market value on the date of exercise equal to the exercise price, (B) if there is a public market for the shares at such time, through the delivery of irrevocable instructions to a broker to sell the shares being acquired upon the exercise of the stock option and to deliver to us the amount of the proceeds of such sale equal to the aggregate exercise price for the shares being purchased or (C) through a "net exercise" procedure effected by withholding the minimum number of shares needed to pay the exercise price. Any fractional shares of common stock will be settled in cash.

Stock Appreciation Rights. The Administrator may grant stock appreciation rights, with terms and conditions determined by the Administrator that are not inconsistent with our 2015 Incentive Plan. Generally, each stock appreciation right will entitle the participant upon exercise to an amount (in cash, shares or a combination of cash and shares, as determined by the Administrator) equal to the product of (i) the excess of (A) the fair market value on the exercise date of one share of common stock, over (B) the strike price per share, times (ii) the number of shares of common stock covered by the stock appreciation right. The strike price per share of a stock appreciation right will be determined by the Administrator at the time of grant but in no event may such amount be less than the fair market value of a share of common stock on the date the stock appreciation right is granted (other than in the case of stock appreciation rights granted in substitution of previously granted awards).

Restricted Shares and Restricted Stock Units. The Administrator may grant restricted shares of our common stock or restricted stock units, representing the right to receive, upon the expiration of the applicable restricted period, one share of common stock for each restricted stock unit, or, in the sole discretion of the Administrator, the cash value thereof (or any combination thereof). As to restricted shares of our common stock, subject to the other provisions of our 2015 Incentive Plan, the holder will generally have the rights and privileges of a stockholder as to such restricted shares of common stock, including, without limitation, the right to vote such restricted shares of common stock (except, that if the lapsing of restrictions with respect to such restricted shares of common stock is contingent on satisfaction of performance conditions other than, or in addition to, the passage of time, any dividends payable on such restricted shares of common stock will be retained, and delivered without interest to the holder of such shares when the restrictions on such shares lapse). To the extent provided in the applicable award agreement, the holder of outstanding restricted stock units will be entitled to be credited with dividend equivalent payments (upon the payment by us of dividends on shares of common stock) either in cash or, at the sole discretion of the Administrator, in shares of common stock having a value equal to the amount of such dividends (and interest may, at the sole discretion of the Administrator, be credited on the amount of cash(including dividend equivalents at a rate and subject to such terms as determined by the Administrator), which will be payable at the same time as the underlying restricted stock units are settled following the release of restrictions on such restricted stock units.

Other Stock-Based and Cash-Based Awards. The Administrator may issue unrestricted common stock, rights to receive grants of awards at a future date, awards that are not stock appreciation rights or restricted stock units or other awards denominated in shares of common stock (including, without limitation, performance shares or performance units) under our 2015 Incentive Plan, including

Table of Contents

performance-based awards, with terms and conditions determined by the Administrator that are not inconsistent with our 2015 Incentive Plan.

Performance Compensation Awards. The Administrator may also designate any award as a "performance compensation award" intended to qualify as "performance-based compensation" under Section 162(m) of the Code. The Administrator also has the authority to make an award of a cash incentive to any participant and designate such award as a performance compensation award under our 2015 Incentive Plan. The Administrator has the sole discretion to select the length of any applicable performance periods, the types of performance compensation awards to be issued, the applicable performance criteria and performance goals, and the kinds and/or levels of performance goals that are to apply. The performance criteria that will be used to establish the performance goals may be based on the attainment of specific levels of our performance (and/or one or more affiliates, divisions or operational and/or business units, product lines, brands, business segments, administrative departments, or any combination of the foregoing) and are limited to the following: (i) net earnings, net income (before or after taxes) or consolidated net income; (ii) basic or diluted earnings per share (before or after taxes); (iii) net revenue or net revenue growth; (iv) gross revenue or gross revenue growth, gross profit or gross profit growth; (v) net operating profit (before or after taxes); (vi) return measures (including, but not limited to, return on investment, assets, capital, employed capital, invested capital, equity, or sales); (vii) cash flow measures (including, but not limited to, operating cash flows, free cash flows, or cash flows return on capital), which may but are not required to be measured on a per share basis; (viii) actual or adjusted earnings before or after interest, taxes, depreciation and/or amortization (including EBIT and EBITDA); (ix) gross or net operating margins; (x) productivity ratios; (xi) share price (including, but not limited to, growth measures and total stockholder return); (xii) expense targets or cost reduction goals, general and administrative expense savings; (xiii) operating efficiency; (xiv) objective measures of customer/client satisfaction; (xv) working capital targets; (xvi) measures of economic value added or other 'value creation' metrics; (xvii) enterprise value; (xviii) sales; (xix) stockholder return; (xx) customer/client retention; (xxi) competitive market metrics; (xxii) employee retention; (xxiii) objective measures of personal targets, goals or completion of projects (including but not limited to succession and hiring projects, completion of specific acquisitions, dispositions, reorganizations or other corporate transactions or capital-raising transactions, expansions of specific business operations and meeting divisional or project budgets); (xxiv) comparisons of continuing operations to other operations; (xxv) market share; (xxvi) cost of capital, debt leverage year-end cash position or book value; (xxvii) strategic objectives; (xxviii) free cash flow before debt service; (xxix) working capital efficiency or (xxx) any combination of the foregoing. Any one or more of the performance criteria may be stated as a percentage of another performance criteria, or used on an absolute or relative basis to measure our performance as a whole or any of our divisions or operational and/or business units, product lines, brands, business segments, administrative departments or any combination thereof as the Administrator may deem appropriate, or any of the above performance criteria may be compared to the performance of a selected group of comparison companies or a published or special index that the Administrator, in its sole discretion, deems appropriate, or as compared to various stock market indices. Unless otherwise determined by the Administrator at the time a performance compensation award is granted, the Administrator will, during the first 90 days of a performance period (or, within any other maximum period allowed under Section 162(m) of the Code) or at any time thereafter to the extent the exercise of such authority at such time would not cause the performance compensation awards granted to any participant for such performance period to fail to qualify as "performance-based compensation" under Section 162(m) of the Code, specify adjustments or modifications to be made to the calculation of a performance goal for such performance period, based on and to appropriately reflect the following events: (1) asset write-downs; (2) litigation or claim judgments or settlements; (3) the effect of changes in tax laws, accounting principles, or other laws or regulatory rules affecting reported results; (4) any reorganization and restructuring programs; (5) extraordinary nonrecurring items as described in Accounting Standards Codification Topic 225-20

Table of Contents

(or any successor pronouncement thereto) and/or in management's discussion and analysis of financial condition and results of operations appearing in our annual report to stockholders for the applicable year; (6) acquisitions or divestitures; (7) any other specific, unusual or nonrecurring events, or objectively determinable category thereof; (8) foreign exchange gains and losses; (9) discontinued operations and nonrecurring charges; and (10) a change in our fiscal year.

Following the completion of a performance period, the Administrator will review and certify in writing whether, and to what extent, the performance goals for the performance period have been achieved and, if so, calculate and certify in writing that amount of the performance compensation awards earned for the period based upon the performance formula. In determining the actual amount of an individual participant's performance compensation award for a performance period, the Administrator has the discretion to reduce or eliminate the amount of the performance compensation award consistent with Section 162(m) of the Code. Unless otherwise provided in the applicable award agreement, the Administrator does not have the discretion to (A) grant or provide payment in respect of performance compensation awards for a performance period if the performance goals for such performance period have not been attained; or (B) increase a performance compensation award above the applicable limitations set forth in the 2015 Incentive Plan.

Effect of Certain Events on 2015 Incentive Plan and Awards. In the event of (a) any dividend (other than regular cash dividends) or other distribution (whethercredited in the form of additional RSUs) for our non-employee directors as of December 31, 2020:

| | | | | | | | |

| Name | | Outstanding RSU Awards |

| Yoon Soo (Gene) Yoon | | 19,902 | |

| Jennifer Estabrook | | 17,721 | |

| Gregory Hewett | | 17,721 | |

| Sean Sullivan | | 17,721 | |

| Steven Tishman | | 17,721 | |

(3) Appointed as Chairman of the Nominating and Corporate Governance Committee on January 1, 2020.

(4) Resigned from the Board of Directors effective December 31, 2019.

(5) Reflects the cash value of fractional shares.

| | | | | | | | | | | | | | |

| 2020 Director Compensation Program |

| | Chair | | Member |

| | | | |

| Annual Board Retainers: | | | | |

| | | | |

Cash Retainer(1) | | $ | 110,000 | | | $ | 70,000 | |

Equity Retainer(2) | | $ | 140,000 | | | $ | 110,000 | |

| | | | |

| Annual Committee Cash Retainers: | | | | |

| | | | |

| Audit Committee | | $ | 25,000 | | | $ | 12,500 | |

| Compensation Committee | | $ | 20,000 | | | $ | 10,000 | |

| Nominating and Corporate Governance | | $ | 12,000 | | | $ | 5,000 | |

(1) In early 2020, in response to the COVID-19 pandemic, our non-employee directors elected to forfeit their cash retainers for 2020. The Compensation Committee monitored the Company's performance throughout the fiscal year and, in light of sustained strong results, the non-employee directors subsequently received a cash retainer restoration payment in early December so that each director received his or her full retainer fee in 2020.

(2) Reflects immediately vesting common stock.

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth, as of December 31, 2020, certain information related to our compensation plans under which shares of the Company’s common stock other securities or other property), recapitalization,may be issued.

| | | | | | | | | | | | | | | | | | | | |

| Plan Category | | Number of Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in 1st Column) |

| Equity compensation plans approved by stockholders: | | | | | | |

| Acushnet Holdings Corp. 2015 Incentive Plan | | 2,511,238 | | (1) | | | 4,105,688 | |

| Equity compensation plans not approved by stockholders | | — | | | N/A | | — | |

| Total | | 2,511,238 | | | | | 4,105,688 | |

(1)Consists of 2,511,238 restricted stock split, reverseunits and performance stock split, reorganization, merger, consolidation, split-up, split-off, spin-off, combination, repurchase or exchangeunits (with performance stock units reported at target).

Pay Ratio Disclosure

For 2020, we determined that the median of the annual total compensation of all of our sharesemployees, other than our CEO, Mr. Maher, was $16,286; Mr. Maher's 2020 annual total compensation was $6,793,749, and the ratio of common stock orthe annual total compensation of our CEO to the median of the annual total compensation of all employees other securities, issuancethan our CEO was 417 to 1.

To identify our median employee, we reviewed our employee population on December 31, 2020 and gathered 2020 year end taxable wages, which was our consistently applied compensation measure, for all employees employed on this date (other than our CEO) in 28 countries around the world. (Approximately 66% of

warrants or other rights to acquire our shares of common stock or other securities, or other similar corporate transaction or event (including, without limitation, a change in control, as defined in our 2015 Incentive Plan) that affects the shares of common stock, or (b) unusual or nonrecurring events (including, without limitation, a change in control) affecting us, any affiliate, or the financial statements of us or any affiliate, or changes in applicable rules, rulings, regulations or other requirements of any governmental body or securities exchange or inter-dealer quotation system, accounting principles or law, such that, in either case, an adjustment is determined by the Administrator in its sole discretion to be necessary or appropriate, then the Administrator must make any such adjustments in such manner as it may deem equitable, including, without limitation, any or all of: (i) adjusting any or all of

(A) the

share limits applicable under our 2015 Incentive Plan with respectemployees included in this analysis are located in countries other than the United States). We did not apply any permitted exclusions or cost of living adjustments. We then converted their 2020 year-end taxable wages to

a common currency - the

number of awards which may be granted thereunder; (B)United States dollar (based on an average exchange rate for 2020) - and rank ordered the

number of our shares of common stock or other securities which may be issued in respect of awards or with respect to which awards may be granted under our 2015 Incentive Plan and (C)employees from the

terms of any outstanding award, including, without limitation, (1) the number of shares of common stock or other securities subject to outstanding awards or to which outstanding awards relate (with any increase requiring the approval of our board of directors), (2) the exercise price or strike price with respect to any award or (3) any applicable performance measures; (ii) providing for a substitution or assumption of awards, accelerating the exercisability of, lapse of restrictions on, or termination of, awards or providing for a period of time for participants to exercise outstanding awards prior to the occurrence of such event; and (iii) cancelling any one or more outstanding awards and causing to belowest paid to the

holders holding vested awards (including any awards that would vest as a resulthighest paid to determine the median. The annual total compensation of

this employee for 2020 was then determined in accordance with the

occurrence of such event but for such cancellation) the value of such awards, if any, as determined by the Administrator (which if applicable may be based upon the price per share of common stock received or to be received by other stockholders in such event), including, without limitation,SEC rules in the